June got in touch with SDS after a little bit of research online and began to turn her life around. She didn’t have to come into the SDS office, but spoke to her advisor, Jane, many times over the phone. “She would do anything; nothing was too much trouble. And if she said she’d get back to you about something, she got back to you. You could trust her.”

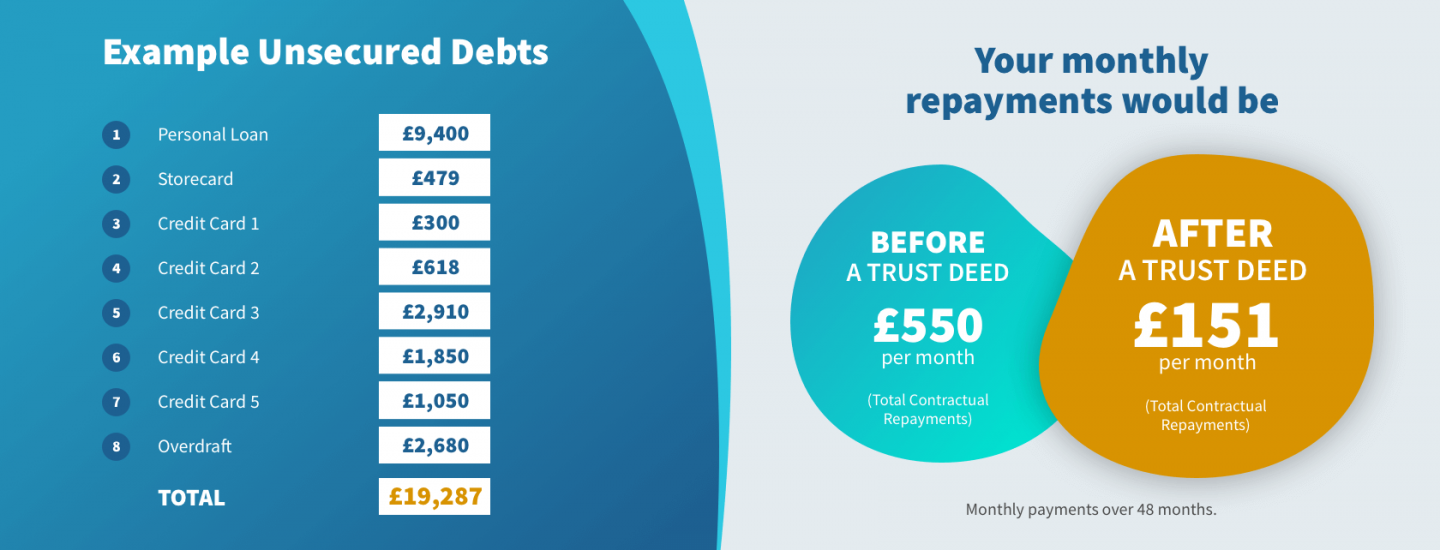

Jane recommended June apply for a Trust Deed.

Once the trust deed was in place, the threatening letters and phone calls June dreaded so much stopped. At Scotland Debt Solutions, we understand the distress this constant communication with the people you owe money to can cause. This is why we make it our responsibility to contact your creditors and inform them that you have entered into a trust deed and that any further communication must now go through us.

Looking to the future

Eighteen months later, June is debt free. Now, if she sees something she wants to buy, she can buy it (with cash, of course!). “It’s as though a weight has been lifted off my shoulders.”

And what would June say to anyone who finds themselves in her situation? “I would say 'go and get help'. Don’t worry yourself to death… There’s always people there who will help you.”