What types of debt can be included in a trust deed?

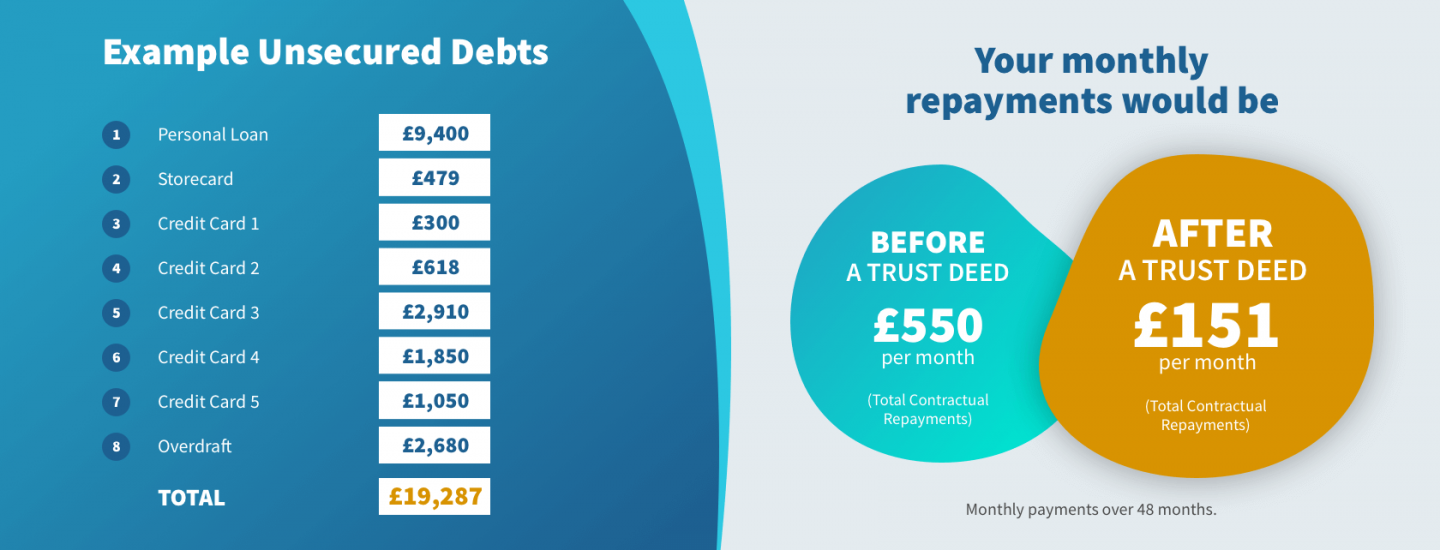

A trust deed is designed to help you repay a proportion of your unsecured debt. This could include credit and store card debt, bank overdrafts or personal loans, payday loans, and catalogue debt. It doesn’t include secured loans such as your mortgage, or hire purchase agreements. If you have these types of debt, repayments are included in the calculation of your essential living costs. This is what makes trust deeds affordable, as your priority payments are budgeted for prior to the trust deed repayment.

What happens at the end of a trust deed?

One of the benefits of entering into a trust deed is that any debt remaining at the end of the term is written off, leaving you debt-free. Your creditors will be aware of the proportion of debt they’re likely to recoup, and cannot pursue you any further for this money once the arrangement comes to an end.

The trust deed remains on your credit record for six years from the start date, even though its term is shorter, and is likely to affect your ability to borrow during this time and potentially beyond.

For more information on how Scottish trust deeds work and whether they’re an appropriate solution for you, contact our experts at Scotland Debt Solutions. With five offices around Scotland we can quickly assess your financial situation and establish your best options. Please call to arrange a free consultation.