Jackie arranged a time to meet her advisor, Sharon, in person, and they discussed her options. She didn’t want to put her house at risk but she wanted to plan a way out of debt and the stress that came with it.

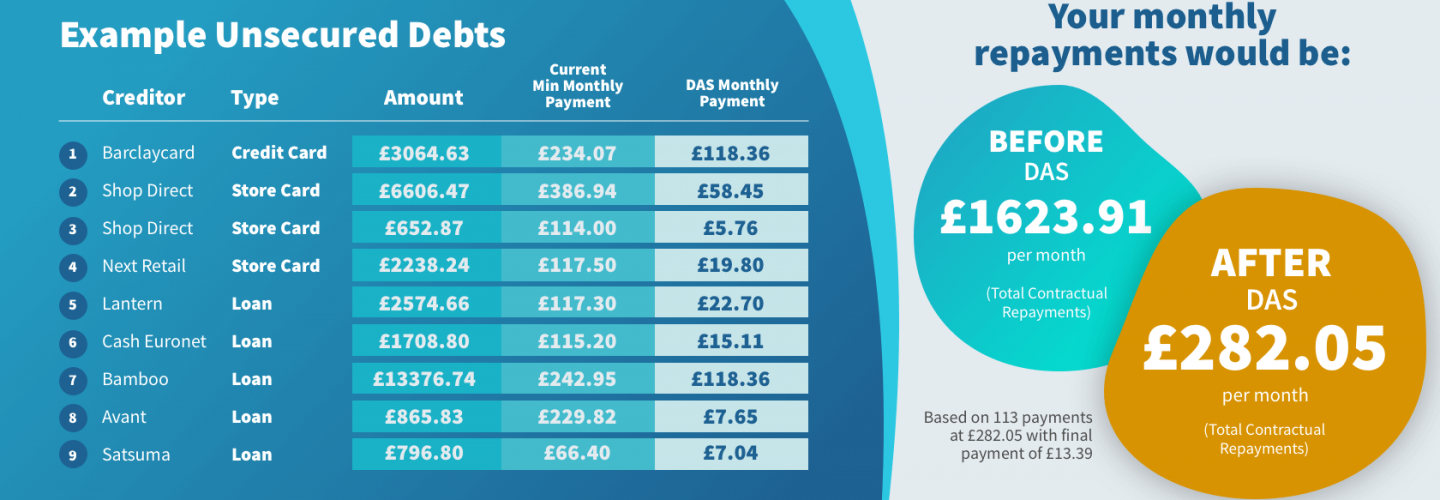

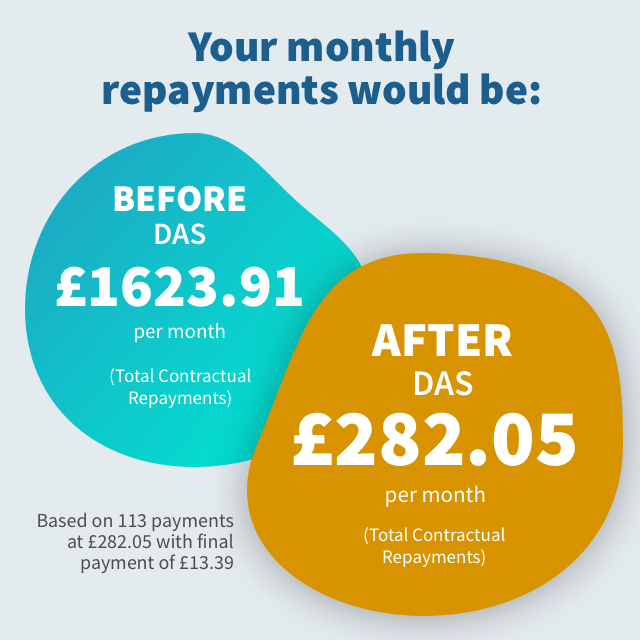

“It was always a worry,” says Jackie. “It would push you down.” Sharon recommended Jackie enter a Debt Arrangement Scheme to clear her debts. SDS would contact her credit card companies on her behalf and take care of everything, giving Jackie peace of mind that everything was under control and that there was an end in sight.

Looking to the future

Jackie now has a route out of debt and a date circled in her diary after which she will be debt free. But her biggest challenge is changing her spending habits now that she doesn’t have a credit card to fall back on. “I have to change,” she says.

And what advice would she give anyone else in the same situation? “Get help,” she says, “because it makes such a big difference to your life. You don’t have that same stress, you don’t have the worry.

There are people out there who can help you...You’ll be starting afresh, almost. A clean slate.”