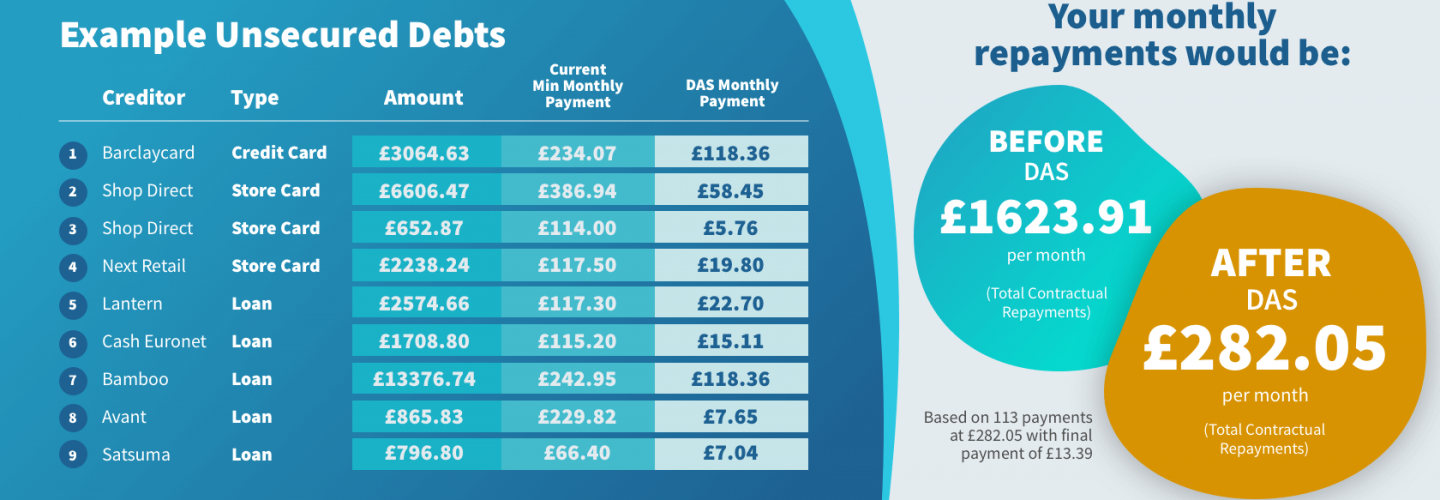

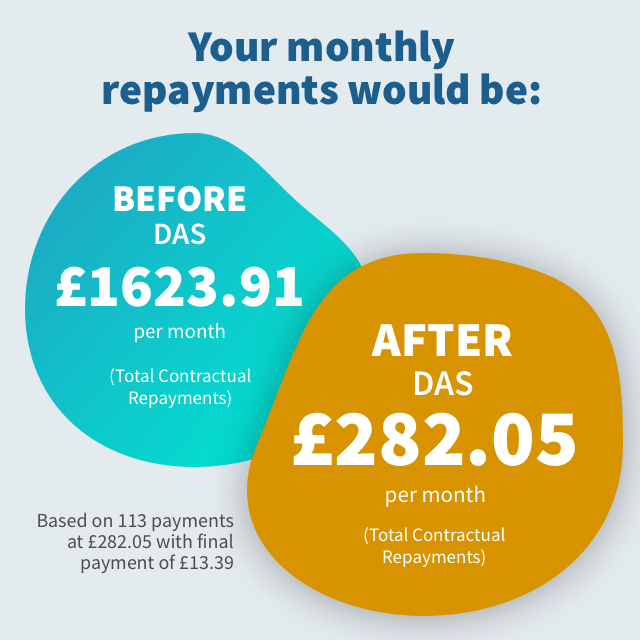

The creation of a Debt Payment Plan that can be agreed upon by both debtors and creditors is a vital part of the process as far as Debt Arrangement Schemes are concerned. The first point of order is to establish precisely what amounts are owed to which creditors by the individual aiming to officially enter a DAS agreement. From there, your DAS Approved Advisor will go through and scrutinise your ability to pay back the amounts you owe in light of your income and your everyday outgoings.

The aim of a DAS is to give indebted individuals a certain amount of breathing space with regard to their debts without resorting to sequestration or a Trust Deed. On the other side of the equation, creditors can at least be assured that the money they are owed will be recovered under the terms of a DAS deal.

Quite how long it might take to pay back debts while a DAS agreement is in place will vary from case to case. However, the idea is to establish a pace of repayment that has a realistic chance of being adhered to on the part of the debtor. A decision on what is or isn’t realistic in each instance is down to the judgement of your Administrator but affordability is a key aspect of the equation as any DPP is put together.