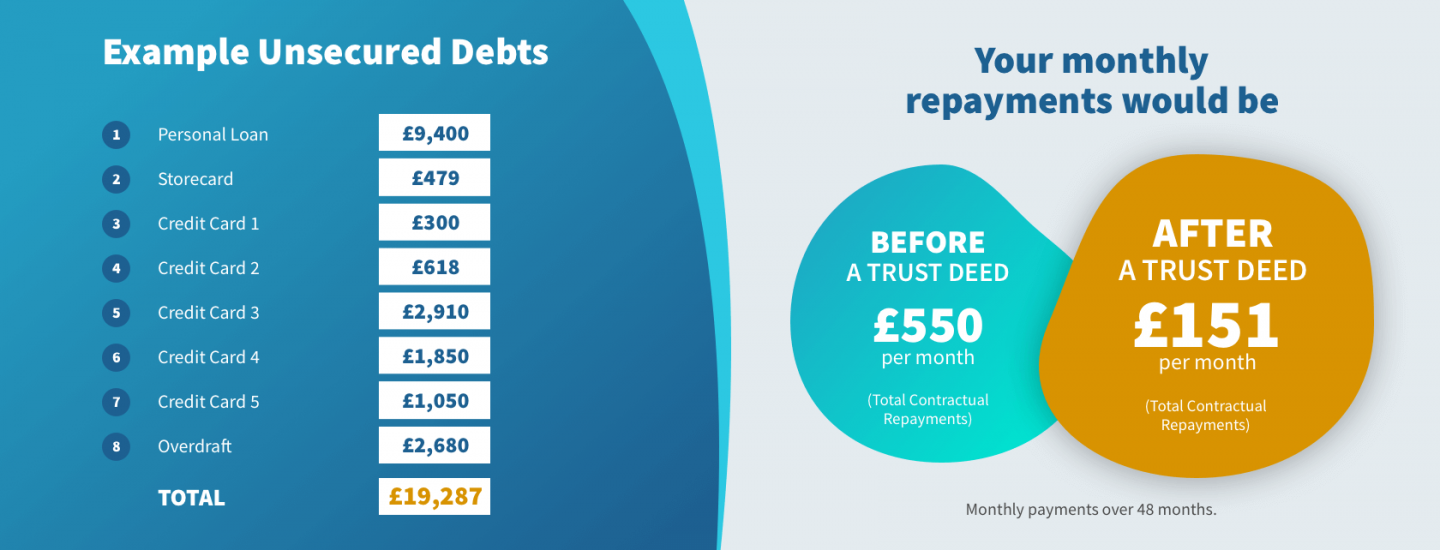

The majority of unsecured debts can be added to a trust deed, including the most popular forms of borrowing such as credit cards, store cards, and personal loans. Any personal VAT or income tax arrears can likewise be included, as can bank overdrafts, payday loans, and catalogue debts. A trust deed cannot be used to pay off secured debts including mortgages, second charges on your property, or hire purchase agreements such as car finance or payment plans on white goods such as fridges or washing machines. You should also check whether any of your loans have been co-signed by a guarantor; these are often asked for when applying for a short-term loan from a company specialising in lending to those with poor credit. There are also other debts which you cannot incorporate into your trust deed. These include:

- Student loans

- Court fines

- Any debt that has been accrued through fraudulent means

If you do have any of these types of outstanding debt, then you are still able to enter into a trust deed, however, you must be aware that these will not be included in the agreement and that you must continue to make the monthly repayments on these separately.