If you’re a resident of Scotland, you owe more than one debt, and are able to repay the money from surplus income, a debt payment programme may be a suitable option. Initially, you’ll need to contact a money adviser approved by the Accountant in Bankruptcy (AiB), to formally establish your eligibility. You can find a directory of approved DAS advisers on the Scotland’s Financial Health Service website, and also on the DAS Scotland website. Once you’ve made contact and arranged a meeting, you should gather together all your relevant financial documentation. This could include bank and credit card statements, personal loan agreements, and any other key information that could help the adviser establish your eligibility. It’s advisable to produce as much information on your financial situation as possible, as it’s possible that other options may be more suitable.

What is the process for a DPP proposal?

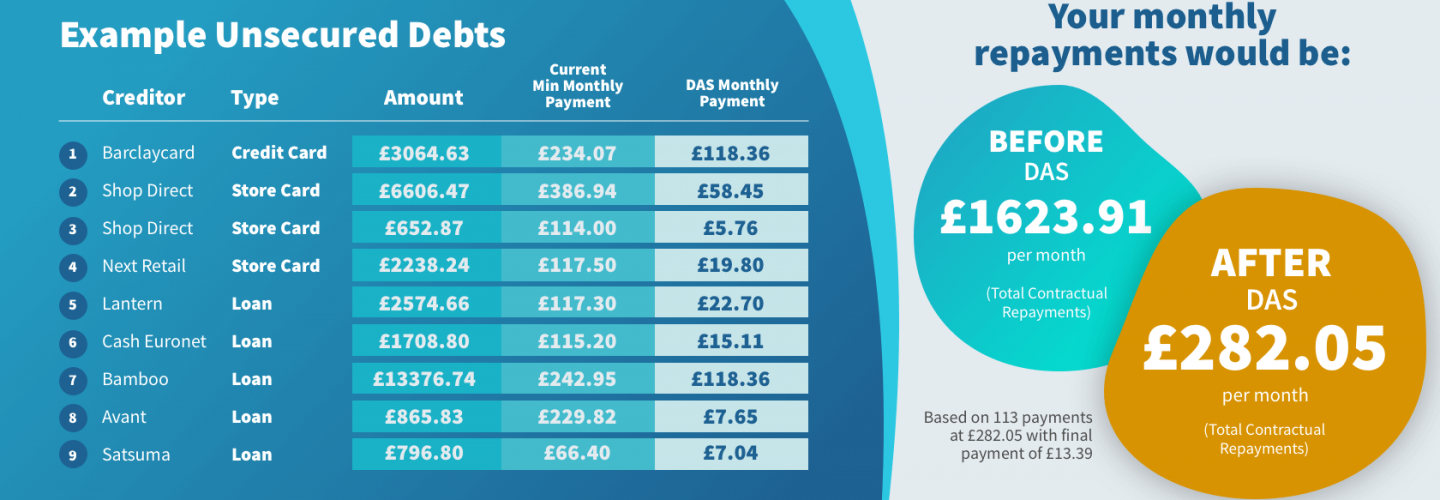

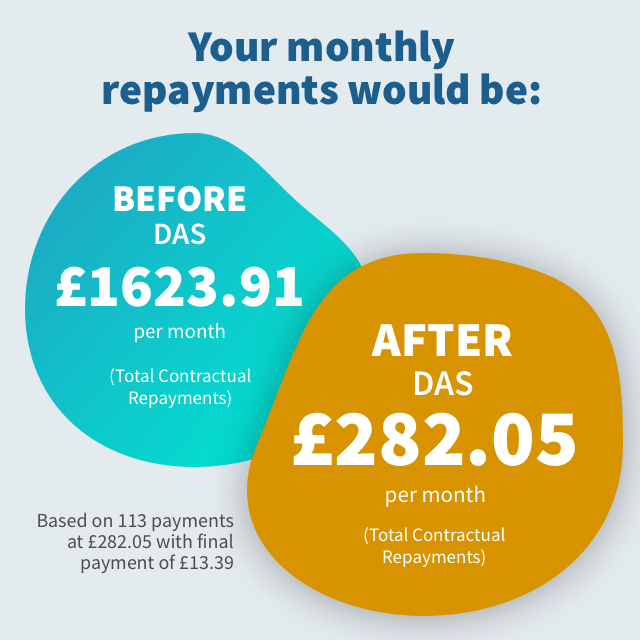

If DAS is appropriate for your circumstances, the adviser will calculate an affordable monthly repayment amount and decide how long the plan should last. They then make a formal proposal to your creditors, who must either accept or reject within 21 days. If they don’t respond, it’s assumed that they agree the terms. It’s worth knowing that if a creditor doesn’t approve the proposal, the plan can be put through if the money adviser believes it to be fair and reasonable. Once the proposed DPP has been accepted, the interest and additional charges on your debts will be frozen as long as you abide by the DPP terms.