How are repayments calculated?

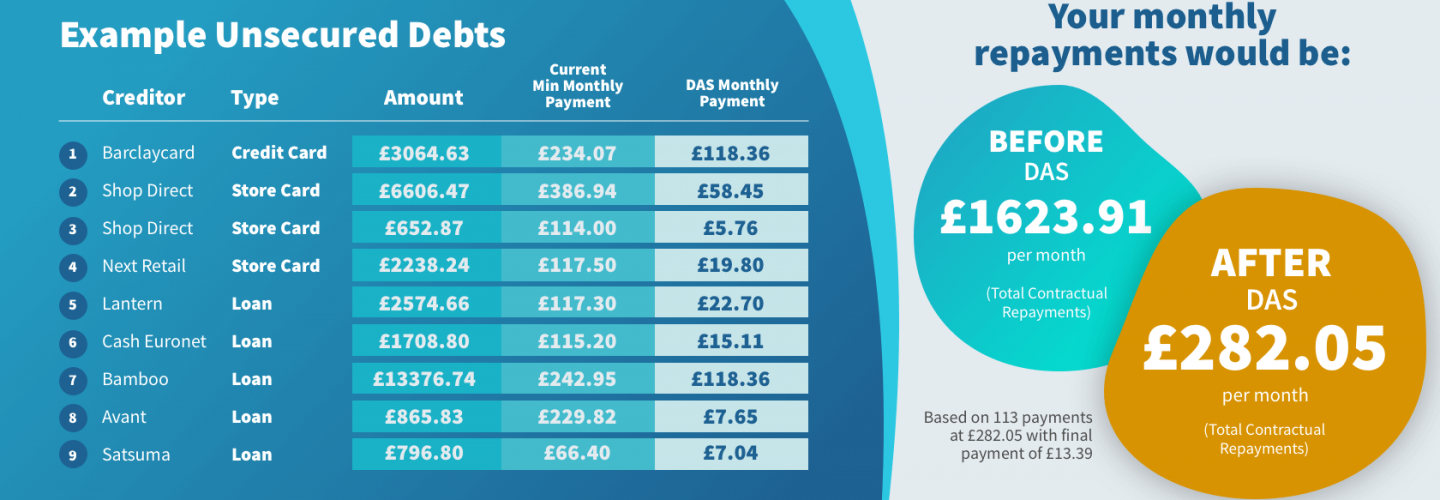

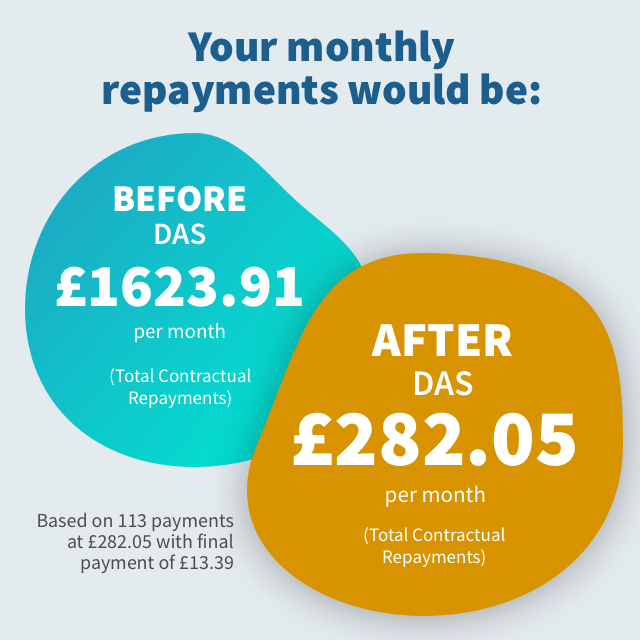

Repayment calculations are based on the amount of residual income after household bills have been met. These include mortgage or rent payments, food, utility bills, clothing, council tax, and other essential bills.

What is the timescale for a Debt Payment Programme?

There is no specific timescale for a DPP – it depends on individual circumstances, and could run for around eight years or more depending on the levels of debt and repayment amounts.

Will I need agreement from creditors?

Agreement to the Debt Payment Programme needs to be obtained from all creditors, although in some cases the Accountant in Bankruptcy has the power to overrule creditors and pass the DPP regardless.

What happens when included in the public DAS Register?

One requirement of entering a Debt Arrangement Scheme is the inclusion of your DPP in the public DAS Register. This means that your financial situation is no longer private, as the online register can be accessed free of charge by members of the public. Details held include your full name, date of birth, home address and any business addresses.

What happens if I fail to adhere to the DPP?

Failing to make at least three agreed payments on time can lead to a revocation of the Debt Payment Programme. This would enable creditors to take legal action against you, and potentially backdate all interest and charges. A revocation may also occur if you subsequently apply for your own sequestration.