Interest and charges are frozen

The addition of interest and charges to the original debt commonly causes debtors to enter a ‘debt spiral.’ This makes repayment very difficult under normal circumstances, especially if you owe several debts, as they increase at a rapid rate.

No contact with creditors

You don’t have to remain in contact with creditors once the debt payment programme comes into effect – all communication should be channelled through the insolvency practitioner overseeing the arrangement.

Avoids bankruptcy

DAS allows you to avoid sequestration (the Scottish term for bankruptcy), and the subsequent loss of assets including property. You also avoid having to release equity in your property if you’re a homeowner, as is sometimes a requirement when you enter into a trust deed.

Cons of the debt arrangement scheme

Debts aren’t written off

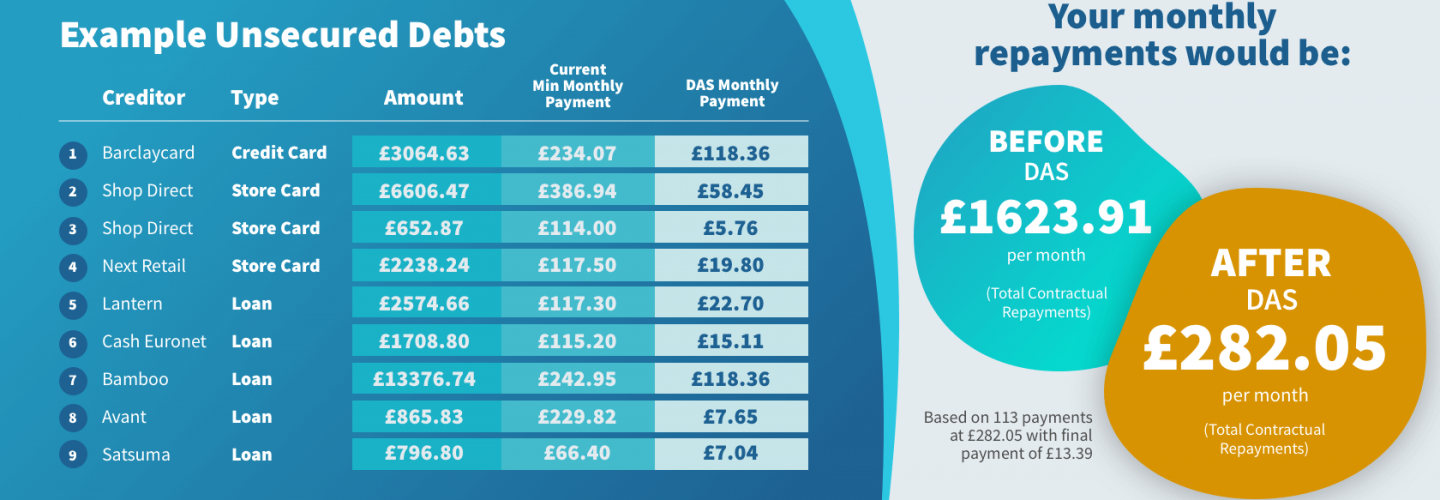

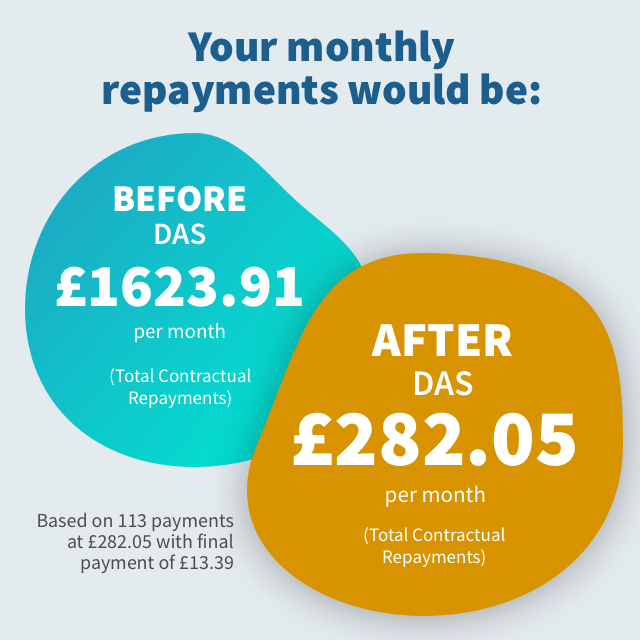

One of the main features of the debt arrangement scheme is that creditors are repaid in full. No debt is written off at the end of the agreement, which means the debt payment programme you sign up to can last a long time.

Can take a long time to repay

As debts are fully repaid, it can take several years or more to complete a debt payment plan. This obviously depends on your individual circumstances, such as your level of debt and monthly income, but the arrangement can last much longer than other formal debt solutions such as a trust deed or sequestration.

Negatively affects your credit rating

Entering into a debt arrangement scheme adversely affects your credit file. It remains on your credit record for six years, and can make obtaining credit or further borrowing difficult during this time and beyond.

You deed to owe more than one debt

One of the eligibility requirements for DAS is that you owe more than one debt. This means that if a single creditor is owed a large amount, you’ll be ineligible for the scheme and may have to consider alternative options. If you would like to find out more about the debt arrangement scheme and how it could help you escape debt, Scotland Debt Solutions are here to provide professional advice and guidance. We specialise in helping Scottish residents out of debt, and offer free consultations at any of our five offices around Scotland.